property tax in nice france

Here is how it is calculated. Taxe foncière is a land tax and is paid by the owner of the property regardless of whether they occupy the property or whether the property is a second home or primary residence.

Taxes In France A Complete Guide For Expats Expatica

For properties less than 5 years old stamp duty is 07 plus VAT at 20.

. You have to pay this tax if you own a property and live in it yourself have it available for your use or rent it out on. Property owned by non-residents is considered to be their secondary place of residence. You pay this tax even if you do not live in the property.

Nonresidents must pay tax on their property in France unless they are exempt under a tax treaty. Sales taxes are the ones you encounter when buying or selling property. If youre selling land or property or.

Social security Social security contributions and surcharges are deducted at source from salary payments with contributions of approximately 20 for the employee. French income tax impôt sur le revenu Social security contributions charges socialescotisations sociales Tax on goods and services taxe sur la valeur ajoutée TVA or VAT in France You also have to pay occupiers tax taxe dhabitation or French property tax taxe foncière. What is property tax in France¹.

If a French non-resident is a resident of a non-cooperating state such as Brunei or Guatemala the rate is 75. For properties more than 5 years old stamp duty is 58 or 509 in some departments. The two property taxes in France are the taxe foncière and the taxe dhabitation although the latter is gradually being phased out by 2020 for most households.

You are liable for this tax if the net value of your property in france exceeds 1300000 euros. The direct tax regime. Rents the charges invoiced to the tenant and the provisions for fees.

Property tax in France is an annual tax and the tax service calculates it separately for a specific owner. The Property tax is generally paid in October. - registration fees also called the notary fees around 75 of the purchase price.

If your property income from furnished rentals is less than 70000 in revenue per year you may benefit from the micro regime. A homebuyer can expect to pay about 7 of the purchase price of an existing property in taxes and fees such as stamp duty notary fees and transfer taxes he said. Property Tax in France Land TaxTaxe foncière.

For example owners of a 2-room apartment on the French Riviera pay property tax on average about 1200 euros per year. French property tax for dummies. - pro rata land tax the seller pays this annual tax but you repay the notary the amount for the current year calculated from the day of completion.

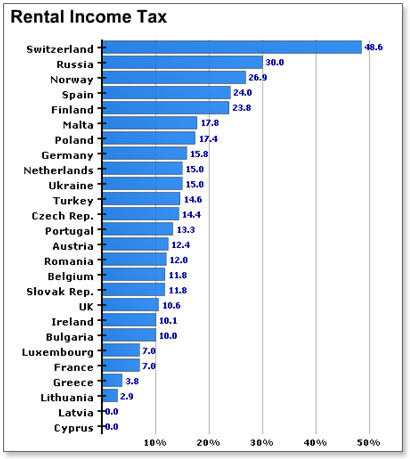

For property tax on the earnings from the sale of properties in France rates are set to 19 for all EU citizens and 3333 otherwise. For French non-residents taxes will usually be taken on France-sourced incomes at a 30 tax rate. An automatic 50 flat abatement applies.

The taxe foncière is used to fund. Anyone who lives in france pays the tax dhabitation. Once you buy a property in France whether built or not you automatically become liable for the land or property tax.

In most countries property tax refers to any tax concerning real estate. This needs consideration whether its a permanent home or a second home. For new developments its more.

Together these taxes are the equivalent to UK Council Tax. Once youve purchased a property youll more than likely need to start paying taxes in France. These include a departmental tax usually 45 of the purchase price as well as a communal tax at the rate of 120 and another government charge of.

Property tax in france is an annual tax and the tax service calculates it separately for a specific owner. Rates are progressive ranging from 05 to 15. Non-residents are liable on French real estate including rights over property situated in France.

The property located in the prestigious neighbourhoods has a higher rental value and accordingly a higher tax. The specific deadline for. The French taxe foncière is an annual property ownership tax which is payable in October every year.

Broadly speaking there are two main categories of French property taxes you need to know about - sales taxes and maintenance taxes. There is no single tax value as a percentage. Compliance for individuals Penalties.

The main two taxes in France for property are the t axe foncière and the taxe dhabitation. For the residents of the EU the tax rate is 19. The first sale of property by residents can be exempt from the capital gains tax.

Any person living abroad and owner of real estate in France is subject to French property tax. It is up to you to decide whether or not to declare your assets to the IFI. Capital gains tax Other than their main home French residents pay capital gains tax on worldwide property at 19 plus surtaxes plus social charges which are generally 172 but can be reduced to 75 for Form S1 holders.

Taxe dhabitation is a residence tax. The tax rate varies between 050 and 150 of the declared value of the goods. As a French property owner you must pay these French property taxes whether you are a permanent resident or use the property as a second home or holiday home.

Property tax in nice france. There are three main types of personal taxes in France. Buying property in France you pay.

Any owner of real estate in France on 1 st January of the taxation year must pay the property tax during the last quarter of the same year after receipt of his tax. You are liable for this tax if the net value of your property in France exceeds 1300000 euros. The tax rate varies between 050 and 150 of the declared value of the goods.

The rate of stamp duty varies slightly between the departments of France and significantly depending on the age of the property. That is to say that you declare everything you have received. Largely speaking these taxes cover local services such as street cleaning waste.

The tax is calculated annually by the public authorities according to the cadastral rental value of the property and the rate determined by the local authorities. There is no exemption. It is payable by the individual who owns the property on the 1st January of the same year and is applicable whether you live in your property or rent it out.

Total the owner will have to pay an annual property tax of 179275 euros 6265 621 1025 475 60. Largely speaking these taxes cover local services such as street cleaning waste. For properties more than 5 years old stamp duty is 58 or 509 in some departments.

Spanish Property Taxes For Non Residents

2966 Sunridge Court West Vancouver Homes And Real Estate Bc Canada Big Mansions Fancy Houses Mansions

Pin By Patrice Kimmerle On Planning Ahead How To Apply How To Plan Planning Ahead

Other Brittany Brittany 56400 France In 2022 Texas Real Estate Brittany Luxury Homes

Taxes In France A Complete Guide For Expats Expatica

Taxe D Habitation French Residence Tax

French Taxes I Buy A Property In France What Taxes Should I Pay

French Taxes I Buy A Property In France What Taxes Should I Pay

Assessor Property Tax Data Scraping Services Data Services Property Tax Online Assessments

Taxes In France A Complete Guide For Expats Expatica

French Taxes I Buy A Property In France What Taxes Should I Pay

La Mere Germaine Villefrance Sur Mer South Of France Picturesque Cote D Azur

French Property Tax Considerations Blevins Franks

Taxes In France A Complete Guide For Expats Expatica

Farmhouse For Sale In Languedoc Roussillon Gard 30 Roquemaure French Property Com Gard Farmhouse French Property

Nice Famous Flower Market On Saleya Court In The Old Town France Voyage Com Beautiful World Picturesque Flower Market

10 Us Cities With Highest Property Taxes Infographic Hr Block Small Business Tax

The Property Tax Handbook For Brrr Btl Investors By Joshua Tharby The Ultimate Tax And Account Property Tax Accounting Investors